|

|||

|

|

|||

|

Executive Summary

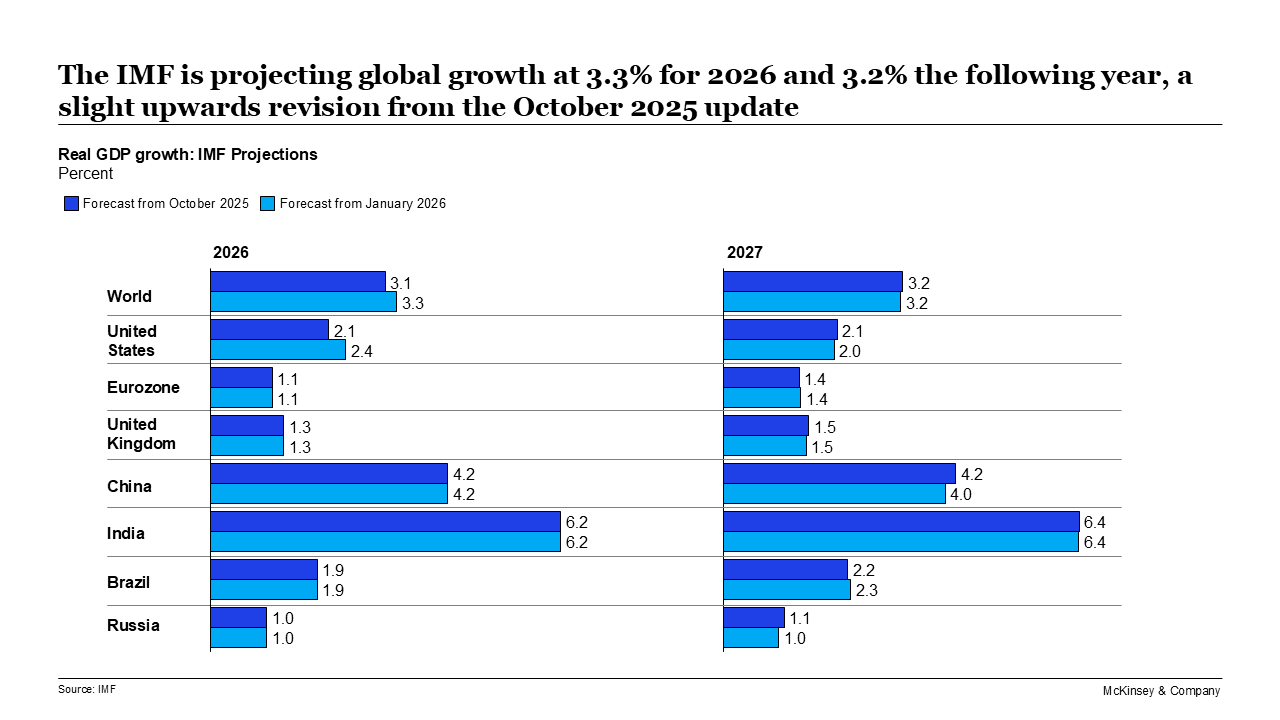

Overall global economic sentiment is improving, with businesses feeling more positive about future growth, in line with the IMF’s upward growth revisions to 3.3% for 2026 and 3.2% for 2027. Several central banks cut interest rates in December as inflation stabilized, though it remains elevated in some economies.

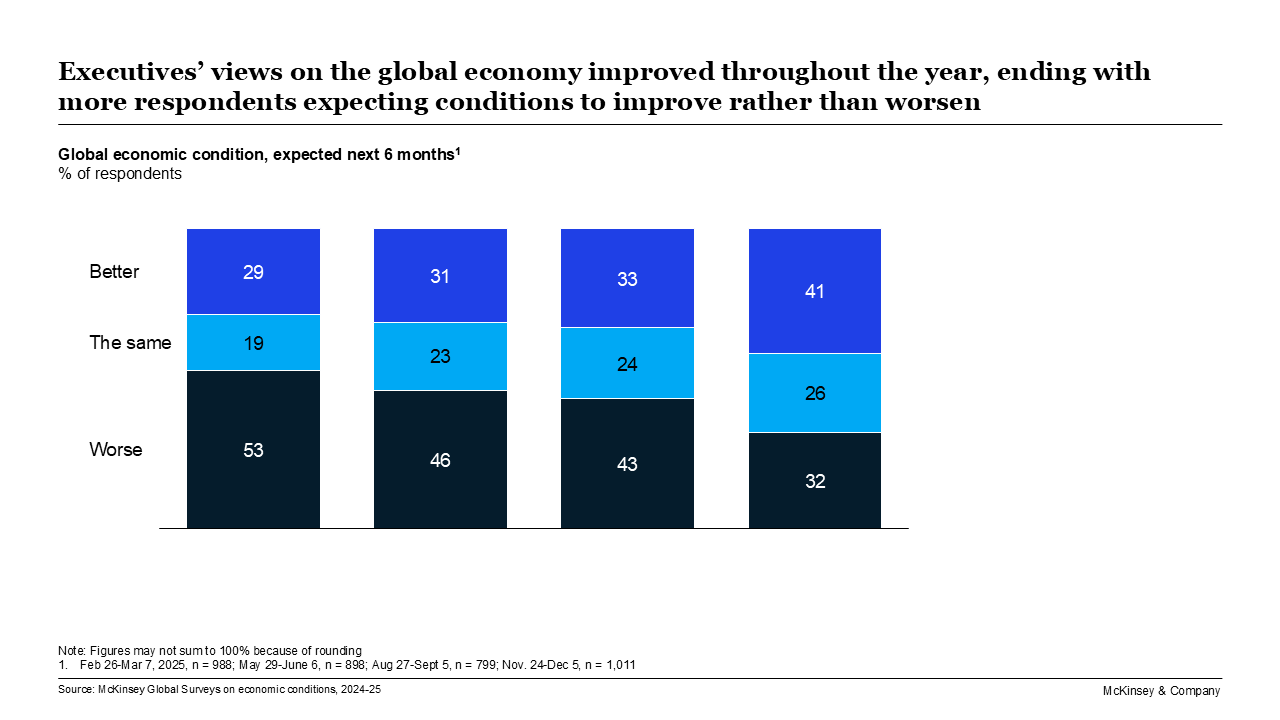

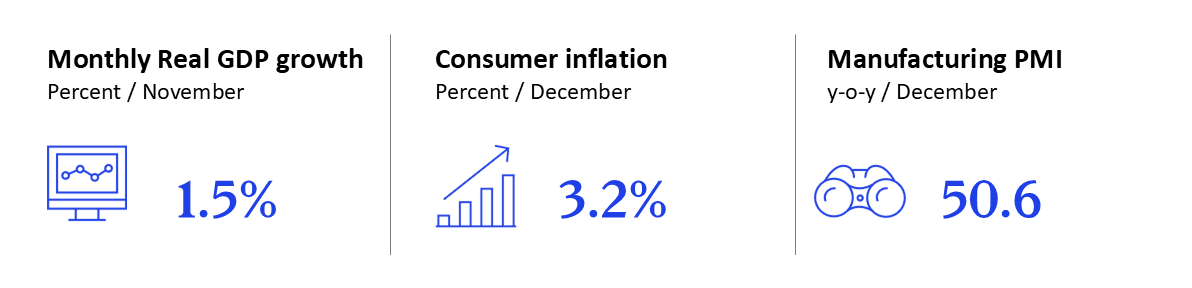

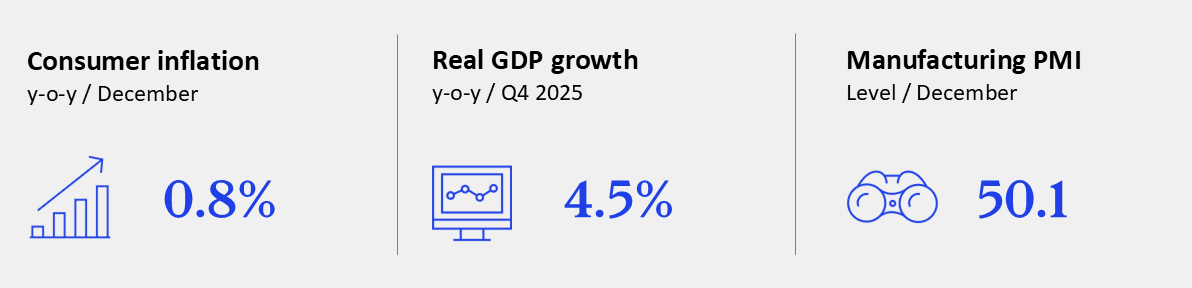

After a year dominated by concerns over trade and global turbulence, businesses are entering 2026 more optimistic—despite continued uncertainty. Indeed, business sentiment was more buoyant in the final quarter of 2025 than in previous quarters, according to the recent McKinsey Global Survey on economic conditions, which received responses from 1,011 participants in 81 nations (representing the full range of regions, industries, company sizes, functional specialties, and tenures). Executives were more upbeat about future economic expectations than they had been in previous 2025 surveys, with respondents expressing the brightest near-term expectations of the year—this in comparison with three previous quarters of largely negative assessments of current global economic and trade conditions. Moreover, for the first time in 2025, the survey recorded more respondents predicting improvement over the following six months versus those expecting worsening conditions. Notably, survey respondents no longer see changes in trade policy as the foremost disruptor of business, although this remains a significant concern. Instead, they point to geopolitical instability as the principal risk. Investment in AI and gen AI continues to be the most reported high priority for business leaders to address, particularly in technology, media, and telecommunications and in service industries. There is further optimism in the IMF’s January 2026 World Economic Outlook update: the IMF is projecting global growth at 3.3% for 2026 and 3.2% the following year, a slight upwards revision from the October 2025 update. It says that technology investment, fiscal and monetary support, accommodative financial conditions, and private sector adaptability have helped to offset trade policy shifts. At the same time, it warns that policymakers should restore fiscal buffers, preserve price and financial stability, reduce uncertainty, and implement structural reforms. Looking back on 2025, we see that the year was one of mixed fortunes for economies around the world. The US economy grew strongly in 2025, with real GDP accelerating through midyear on higher consumer spending and exports. GDP for Q3 2025 rose by 4.3% (annual rate) versus 3.8% in Q2. The real GDP increase reflected higher consumer spending, exports, and government spending that were partly offset by a decrease in investment. Meanwhile, the Chinese economy grew by approximately 5.0% in 2025 and India expanded by some 6.5% on an annual basis on the back of resilient services activity and domestic demand. By contrast, eurozone growth is expected to be 1.4% in 2025, while UK real GDP expanded in November, driven primarily by a rebound in production sectors, but remains modest. In the United States, consumer sentiment is trending down, dropping to 89.1 in December from November’s revised figure of 92.9. Nevertheless, November’s retail and food services sales (adjusted for seasonal variation and holiday and trading-day differences) were $735.9 billion, up 0.6% from October’s revised $731.4 billion. Overall, retail sales continue to grow across most countries, with some acceleration observed in November and December due to the holiday season. Against this backdrop, central banks have been cutting interest rates to stimulate their economy, where they feel they have room for maneuver. Although central banks in Brazil, China, and the eurozone refrained from cutting rates, other major central banks delivered 25-basis-point cuts in December. |

|||

|

|

|||

|

|||

|

|

|||

|

Looking at prices, we see that inflation across developed economies remained broadly stable in December. Among the emerging economies, inflation in India and China picked up from near zero, while in Brazil and Russia it continues to decelerate.

Overall inflation expectations have been oscillating around 2.2%. In the US, December, median inflation expectations increased at the one-year-ahead horizon, to 3.4% (from 3.2%), but remained steady at the three-year-ahead and five year-ahead horizons—both at 3.0%. The consumer price index (CPI) increased 2.7% year over year in December—the same pace as November—while core inflation was slightly up, to 2.6% (annualized). Among other developed economies, eurozone inflation is lower, with the headline figure projected to decrease from 2.1% in 2025 to 1.9% in 2026 and 1.8% in 2027, before rising to 2.0% in 2028, mainly owing to energy inflation. Meanwhile, UK CPI ticked up to 3.2% in December, while core inflation was slightly higher at 3.3%, indicating that underlying pressures have moderated from post-pandemic peaks but are not yet fully contained. Among the emerging economies, the picture is also mixed. In China and India, inflation is low or negative. Consumer prices in China continued their recovery to 0.8% in December (0.7% in November), while core CPI was unchanged at 1.2%. Deflation in producer prices continued to ease slightly to –1.9% in December, from –2.2% in November. In India, CPI inflation was recorded at 1.33% year on year in December 2025 (provisional), while food inflation remained in contraction at –2.71% year on year. However, it’s a different story in Russia where tight monetary policy is still required to achieve the Central Bank of Russia’s inflation target of 4%. Recently, inflation has slowed to 7% in November and 6% in December but a rise in VAT and regulated prices for municipal services will create upward pressure and has already started to boost expectations. In Brazil, inflation is more modest, touching 4.26% in December (versus 4.46% in November) and coming in below the central bank’s upper target limit of 4.50% for a second consecutive month. Mexico’s annual inflation declined to 3.7% in December, down from 3.8% in November, reinforcing the ongoing disinflationary trend. On the commodities markets, gold exceeded $5,000 per ounce—a level never seen before—before cooling somewhat. At the same time, oil prices have eased as supply increased and demand remained broadly stable, with only modest growth expected in 2026. Food prices have also eased, driven mainly by dairy prices, which declined on seasonal increases in cream and milk availability. Both manufacturing and services indicators ended the year on a weaker note, as growth rates of new orders and output eased; however, companies remain positive about 2026. Manufacturing sectors around the world are either contracting or slowing down; companies do not see growth in new orders or employment, while stocks of purchases are declining. In parallel, services growth eased across most countries at the end of 2025. Looking at the purchasing managers’ indexes, we see that the US industrial production index decreased slightly to 102.3 in December. Similarly, S&P’s Manufacturing PMI fell to 51.8 in December 2025 (52.2 in November), the lowest in five months. However, in the eurozone, despite a marginal decline in the Economic Sentiment Indicator and the composite purchasing managers’ index (PMI) at the end of 2025, the industrial production index is gradually improving. This moderate momentum is further confirmed by the Eurocoin indicator, which rose to 0.52 in December. Services and construction are the primary drivers of this modest growth, with the construction PMI at its highest level in over two years (though still negative). In India, business surveys pointed to continued expansion but moderating momentum as 2025 ended. The HSBC India Manufacturing PMI eased from 56.6 in November to 55.0 in December (still comfortably in expansion), indicating growth but at a slower pace amid competitive pressures and softer sales in some categories. In Brazil, manufacturing production has dropped: the Monthly Industrial Physical Production (PIM) Index decreased from 113.04 in October to 103.4 in November (although still above the neutral 100 line). The negative movement was driven by extractive production, which fell 6.9%, while factory production has decreased 8.8%. On aggregate, however, November’s 2025’s results were only 1% below those from the same period last year. The Mexico Manufacturing PMI fell from 47.3 in November to 46.1 in December, signaling a further deterioration in operating conditions. The index has remained below the 50.0 expansion threshold for 19 of the past 20 months. New orders declined in both November and December, while new export orders contracted further, extending the downturn in external demand to 22 consecutive months. |

|||

|

|

|||

|

|||

|

|

|||

|

On the services front, the US services PMI edged down to 52.5 (54.1 in November). Services activity in India also cooled but remained strong: the HSBC India Services PMI was at an 11-month low of 58.0 in December (down from November’s 59.8) as new business growth softened while export demand held up better. Brazil’s Monthly Services Survey (PMS) revenue index slid slightly to 127.7 in November from 128.7 in October (staying above the neutral 100 line). This was mirrored in the volume index, which declined to 111.1 (from 112.8).

US total non-farm payroll employment increased in December (+50,000) but has shown little change since April. The unemployment rate remained at 4.4%. Across the Pond, the number of paid employees in the UK has been trending lower since 2024, while unemployment has remained broadly stable at 5.1%, with a renewed rise among workers aged over 50. Vacancies have held roughly flat at around 700,000, pointing to softer hiring momentum than earlier in the cycle. In China, the overall surveyed urban unemployment rate stuck at 5.1% for a third consecutive month. The youth unemployment rate eased slightly to 16.5% in December (16.9% in November). Labor market conditions displayed mixed signals in Mexico. The unemployment rate rose to 2.7% in November, up from 2.6% in October. At the same time, formal employment reached a record high, with 22.8 million registered jobs in November. A total of around 48,600 formal jobs were created during the month. Equity markets globally started 2026 on a strong note, with indexes rising and reaching record highs in most economies. The cost of capital moved sideways in January. In the US, the S&P 500 was down 0.1% in December, bringing the one-year return to 16.4%; the Dow Jones gained 0.7% over the month and was up 13.0% year to date. UK equities gained ground in December, with the FTSE 100 rising by around 1% and sectoral performance broadly even, as investors priced in lower policy rates and a stabilizing growth outlook. Government bond yields were largely stable across maturities, although 20-year yields declined, consistent with easing long-term inflation expectations following the Bank of England’s rate cut and improving disinflation signals. Brazil’s Bovespa equities index trended higher in December, rising 1.2% in value; January 2026 results up until the 16th were already climbing higher, up 2.7%. Export growth strengthened across most major economies through October 2025, while import growth was mixed across over this period. Total seaborne volumes softened into November, while container throughput cooled after mid-year strength. Logistics conditions remained broadly normal in November, with a modest uptick in global supply-chain stress in December. Inbound spot freight rates also ticked up in December but remained well below mid-2025 highs. Outbound freight rates to Shanghai eased after June’s spike and stabilized into year-end. In the US, the monthly deficit fell by 39.0% to $29.4 billion in October. Exports reached $302.0 billion, $7.8 billion more than in September, while October imports reached $331.4 billion, $11.0 billion less than in September. The UK’s overall trade deficit in goods and services narrowed slightly in November, but this masked offsetting regional trends. Trade volumes were broadly balanced between EU and non-EU partners, yet imports from non-EU economies rose more sharply, contributing to a deterioration in that segment of the trade balance. In China, cross-border trade (imports and exports) experienced a year-on-year growth rate of 6.2% in December, a rebound from the 4.3% increase seen the previous month. Export growth accelerated to 6.6% in December, from the 5.9% in November, while imports also witnessed a recovery to 5.7% from November’s 1.9%. India trade data for December 2025 pointed to a wider deficit as imports outpaced exports. The Ministry of Commerce estimated total exports (merchandise plus services) at $74.01 billion and total imports at $80.94 billion for December 2025. Brazil’s December’s trade balance recorded a surplus of US $9.6 billion, according to preliminary data, up from US $5.8 billion in November. The larger surplus was driven by an increase in exports (US $31 billion in December, up from US $28.5 billion in November), accompanied by a drop in imports (US $21.4 billion in December, down from US $22.5 billion in November). Mexico posted a trade surplus of US $663 million in November, as imports declined slightly more than exports, resulting in a positive balance despite a broad monthly contraction in trade flows. Exports fell to US $56.4 billion from US $66.1 billion in October, while imports declined to US $55.7 billion from US $65.5 billion. The surplus was largely driven by an improved non-petroleum trade balance, which more than offset the petroleum deficit, and reflected weaker import demand rather than a strengthening of export dynamics.

***

A bold new book from McKinsey Global Institute supports an optimistic view of progress and economic development over coming decades. A Century of Plenty: A Story of Progress for Generations to Come (McKinsey Global Institute, January 13, 2026) imagines a world in which every person in the world enjoys at least Switzerland’s standards of living today—a hypothesis that the authors stress tested and concluded is physical possible. |

|||

|

|

|||

|

|||

|

|||

|

Regional and Country Summary

Fed and Bank of England both cut rates by 25 basis points in December; Eurozone GDP delivers upside surprise.

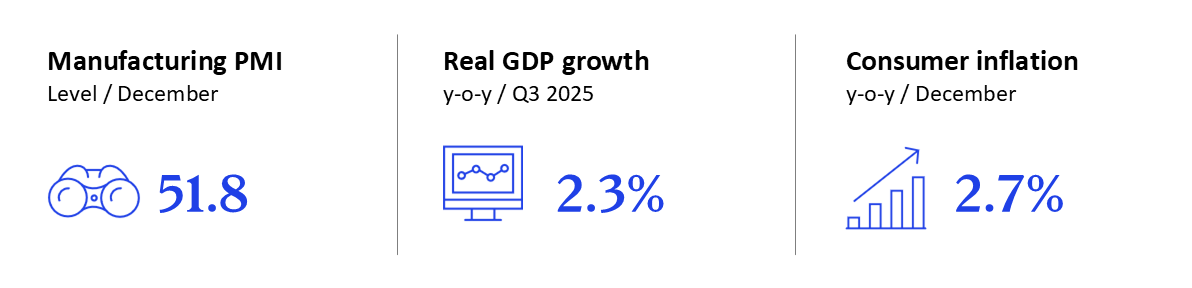

United States Bureau of Economic Analysis released shutdown-delayed estimate for Q3 2025 GDP, reporting real GDP rose 4.3% (annual rate) versus 3.8% in Q2; real GDP increase reflected higher consumer spending, exports, and government spending that were partly offset by a decrease in investment. October’s exports reached $302.0 billion, $7.8 billion more than in September. October imports were $331.4 billion, $11.0 billion less than September’s imports. The monthly deficit fell by 39.0% to $29.4 billion. The consumer price index (CPI) increased 2.7% year over year in December—the same pace as November. Core inflation was slightly up, to 2.6% (annualized). In December, median inflation expectations increased at the one-year-ahead horizon to 3.4% (from 3.2%). They remained steady at the three-year-ahead and five year-ahead horizons—both at 3.0%. Total non-farm payroll employment increased in December (+50,000) but has shown little change since April. The unemployment rate remained at 4.4%. On the housing market, the 30-year fixed-rate mortgage decreased slightly to 6.2% in December. Existing home sales rose 5.1% in December. During October, housing residential starts decreased to 1,246,000 (below the revised September estimate of 1,306,000), a 4.6% drop. Completions in October were up, reaching 1,386,000, a 1.1% increase from a revised September estimate of 1,371,000. |

|||

|

|

|||

|

|||

|

|

|||

|

November’s retail and food services sales (adjusted for seasonal variation and holiday and trading-day differences) were $735.9 billion, up 0.6% from October’s revised $731.4 billion. The Consumer Confidence Index (Conference Board) dropped to 89.1 in December, from November’s revised 92.9.

The industrial production index decreased slightly to 102.3 in December. S&P’s Manufacturing PMI fell to 51.8 in December 2025 (52.2 in November), the lowest in five months; the services PMI edged down to 52.5 (54.1 in November). In December, the S&P 500 was down 0.1%, bringing the one-year return to 16.4%; the Dow Jones gained 0.7% over the month and was up 13.0% year to date. During October, the CBOE Volatility Index closed at 14.9 (16.3 in November). The Federal Reserve announced in December that it had lowered the target range for the federal funds rate by 25 basis points to 3.5–3.75%. The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. On January 3, 2026, the United States carried out a military operation in Venezuela that resulted in the capture of President Nicolás Maduro and his wife, who were removed from Venezuela and transferred to US custody. The pair later appeared in federal court in New York on narcotics and weapons-related charges. |

|||

|

|

|||

|

|

|||

|

Eurozone

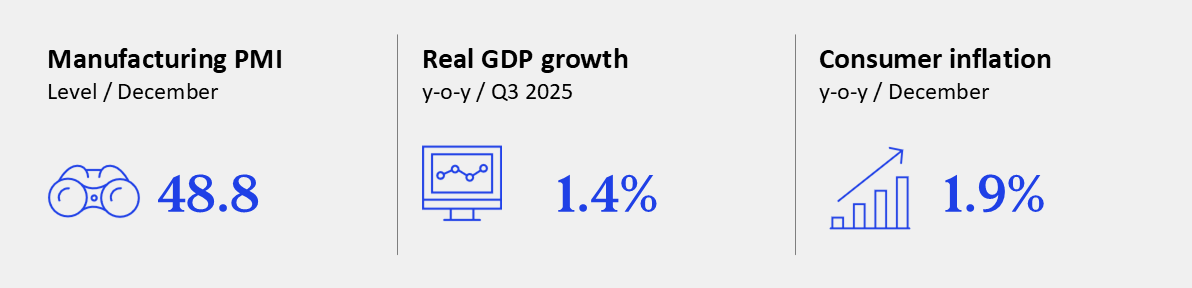

GDP delivered upside surprise; resilient domestic activity; headline inflation remains on target. Eurozone GDP delivered an upside surprise in Q3 by growing at 0.3% quarter over quarter—0.0% was the expectation in September. The economy has been resilient, mainly reflecting stronger consumption and investment. By sector, growth shows some momentum in services such as information and communications technology (ICT). Given this services-led growth, the picture across member states is mixed. Portugal and Spain led the way with robust growth (0.8% and 0.6% quarter on quarter, respectively), while France emerged as the standout performer by growing at 0.5% quarter on quarter, defying political and fiscal challenges to post stronger-than-expected results. In contrast, Germany and Italy’s economies stagnated (0.0% and 0.1% quarter over quarter, respectively), as their large industrial sectors continued to grapple with the fallout from higher tariffs and global trade tensions. European Central Bank (ECB) Q4 projections suggest continuing moderate growth at 0.2% quarter over quarter. Despite a marginal decline in the Economic Sentiment Indicator and the composite purchasing managers’ index (PMI) at the end of 2025, the industrial production index is gradually improving. This moderate momentum is further confirmed by the Eurocoin indicator, which rose to 0.52 in December. Services and construction are the primary drivers of this modest growth, with the construction PMI at its highest level in over two years though still negative. The ECB forecasts 1.4% growth in 2025 (+2pp from September) with growth of 1.2% in 2026 (+0.2pp) and 1.4% in 2027 (+0.1pp). However, the outlook remains clouded by weaker global demand and heightened uncertainty, constraining exports. The uncertainty around US and EU trade deals will continue to play a decisive role in shaping macroeconomic performance. |

|||

|

|

|||

|

|||

|

|

|||

|

Household spending is expected to remain the main engine of growth, as fundamentals—such as a rise in real incomes, a resilient labor market (unemployment rate is close to its lowest with employment growing at 0.2%), and savings rates expected gradually to reduce—continue to support consumer spending. Business investment and substantial government spending on infrastructure and defense should increasingly underpin the economy as well.

On December 18, the European Central Bank (ECB) held its key interest rate steady, as expected, for the fourth consecutive meeting, keeping the deposit rate at 2.0%, a significant drop from its peak of 4.0%. Headline inflation eased to 1.9% in October, but core inflation remained at 2.4%, with a stalled disinflation process in the services sector posing some upside risk. Headline inflation is projected to decrease from 2.1% in 2025 to 1.9% in 2026 and 1.8% in 2027, before rising to 2.0% in 2028, mainly owing to energy inflation. |

|||

|

|

|||

|

|

|||

|

United Kingdom

Economy ends year on a high note, but still a long way to go to get back to pre-pandemic momentum or achieve government and central bank targets. UK real GDP expanded in November, driven primarily by a rebound in production sectors—most notably manufacturing—while construction disappointed with a year-on-year decline. Industrial output rose on the back of higher energy and capital-goods production, suggesting that parts of the industrial base entered the year on a firmer footing. However, the uneven sectoral pattern underscores that the recovery remains fragile rather than broad-based. The number of paid employees has been trending lower since 2024, while unemployment remained broadly stable at 5.1%, with a renewed rise among workers aged over 50. Vacancies held roughly flat at around 700,000, pointing to softer hiring momentum than earlier in the cycle. Nominal pay growth remained strong at around 5% overall but masks a sharp divergence between public and private sectors: public-sector wages rose about 7.4%, compared with 4.2% in the private sector. The consumer price index (CPI) ticked up to 3.2% in December, while core inflation was slightly higher at 3.3%, indicating that underlying pressures have moderated from post-pandemic peaks but are not yet fully contained. Against this backdrop, the Bank of England cut its policy rate by 25 basis points to 3.75% in December, citing progress on disinflation and weaker activity indicators, while emphasizing that future easing would be gradual and dependent on further cooling in wages and services prices. |

|||

|

|

|||

|

|||

|

|

|||

|

Retail sales excluding fuel rose by 3.1% in December, partly reflecting seasonal spending, while consumer confidence improved into January and reached its highest level since 2024. Survey respondents reported greater optimism about their own financial situations, employment prospects, and easing price pressures over the coming year, even as they remained cautious about the broader macroeconomic environment.

Still-elevated mortgage rates—around 4.5%—and slowing house-price growth continued to weigh on housing activity; annual house-price inflation slowed sharply to just 0.3% in December. The UK’s overall trade deficit in goods and services narrowed slightly in November, but this masked offsetting regional trends. Trade volumes were broadly balanced between EU and non-EU partners, yet imports from non-EU economies rose more sharply, contributing to a deterioration in that segment of the trade balance. Official trade commentary points primarily to volatile commodity flows—especially precious metals—rather than tariff changes as the main driver, suggesting that compositional effects rather than policy shifts were behind the month-to-month swings. Equities gained ground in December, with the FTSE 100 rising by around 1% and sectoral performance broadly even, as investors priced in lower policy rates and a stabilizing growth outlook. Government bond yields were largely stable across maturities, although 20-year yields declined, consistent with easing long-term inflation expectations following the Bank of England’s rate cut and improving disinflation signals. The end of the month saw Prime Minister Sir Keir Starmer meet China’s President Xi Jinping in Beijing as part of a UK trade push. A new visa agreement will allow UK citizens to visit China for 30 days without a visa. The countries also agreed to start exploratory talks on a services agreement to establish clear and legally binding rules for UK firms doing business in China. |

|||

|

|

|||

|

|

|||

|

Mixed signals from China’s economic activities; December sees India’s RBI cut repo rate by 25 bps in December and Russia’s CBR reduce rate by 50 basis points to 16%.

China

In December, China’s economic activities sent out mixed signals: growth rates decelerated in investment and retail sales but accelerated in industrial production and trade. China’s industrial output growth increased to 5.2% year on year in December, compared with 4.8% in November. Looking at individual sectors, the manufacturing sector’s output picked up to 5.7% growth, from 4.6% expansion in November. The mining sector’s output growth declined to 5.4%, 0.9 percentage points lower than in November. Meanwhile, the utility sector’s output growth dropped rapidly to 0.8%, compared to 4.3% in November. Investment declined further in December at a double-digit pace. Overall fixed-asset investment registered a year-on-year shrinkage of –16.0% in December, down further from November’s –11.1%. The contractions happened across sectors: manufacturing investment growth dropped to –10.6% in December, from –4.5% recorded in November. Infrastructure investment growth slowed as well, ending up at –12.2% in December (versus –9.7% in November). Real estate investment continued to weaken with a contraction of −38.5% (–29.7% in November). The real estate market downturn continued in December. On the demand side, floor space sold for new residential properties was down –18.9% year on year—a similar pace to November’s –19.1% drop. On the supply side, the contraction in floor space started narrowed to –18.8% year on year in December, slowing from a –26.8% contraction in November. |

|||

|

|

|||

|

|||

|

|

|||

|

In December, new increased credit fell to RMB 2.2 trillion, up from RMB 2.5 trillion in November. Meanwhile, total social financing reached RMB 442.1 trillion in December, marking an 8.3% year-on-year increase, down from 8.5% in November.

The overall surveyed urban unemployment rate stayed at 5.1% for a third consecutive month. The youth unemployment rate eased slightly to 16.5% in December (16.9% in November). In December, cross-border trade (imports and exports) experienced a year-on-year growth rate of 6.2%, a rebound from the 4.3% increase seen the previous month. Specifically, export growth accelerated to 6.6% in December, from the 5.9% in November. Meanwhile, import growth also witnessed a growth recovery to 5.7% from November’s 1.9%. |

|||

|

|

|||

|

|

|||

|

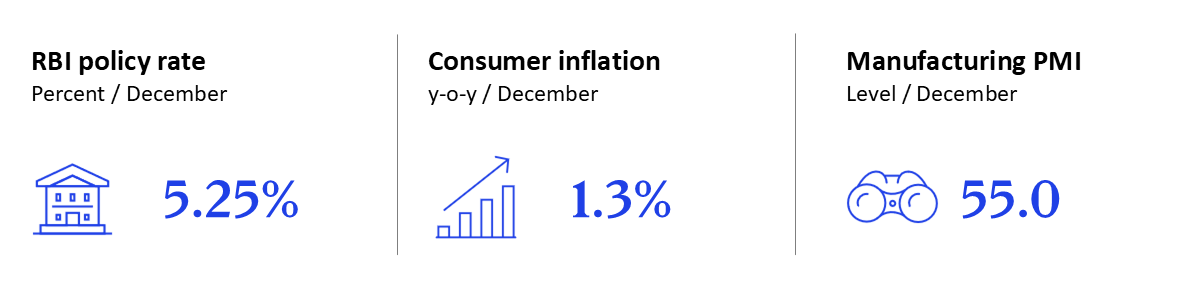

India

India’s economy remained resilient through December 2025 and into January 2026, continuing to benefit from strong domestic demand even as external headwinds intensified; RBI cut repo rate by 25 bps in December. Sustained growth momentum and a relatively benign inflation environment leave India well positioned to overtake Japan and become the world’s fourth-largest economy in terms of nominal GDP. Business surveys pointed to continued expansion but moderating momentum as 2025 ended. The HSBC India Manufacturing PMI eased from 56.6 in November to 55.0 in December (still comfortably in expansion), indicating growth but at a slower pace amid competitive pressures and softer sales in some categories. Services activity stayed strong but cooled, with the HSBC India Services PMI at an 11-month low of 58.0 in December (down from November’s 59.8) as new business growth softened while export demand held up better. Hard activity indicators were mixed but showed improvement in parts of the industrial core. The Index of Eight Core Industries rose to 3.7% year-on-year growth in December 2025 (a four-month high), supported by stronger output in cement and fertilizers, even as performance remained uneven across energy-linked components. |

|||

|

|

|||

|

|||

|

|

|||

|

All-India consumer price index (CPI) inflation was 1.33% year on year in December 2025 (provisional), while food inflation remained in contraction at –2.71% year on year, reinforcing the narrative of easing price pressures and giving the Reserve Bank of India (RBI) more room to support growth if needed. This soft inflation backdrop aligned with RBI’s December easing and its updated projections in the policy communication.

That resilience was tested on the external and portfolio-flow front. Foreign portfolio investors (FPIs) started 2026 on a cautious note, with net equity outflows of 225.3 billion rupees (US $2.45 billion) up to January 16, 2026 as reported in National Securities Depository Limited’s (NSDL) FPI flow data—reflecting renewed sensitivity to global risk conditions and India’s relative valuations. The trade environment also remained a key swing factor: export momentum cooled sharply from November’s high, with reporting attributing part of the December slowdown to the drag from US tariffs imposed in August. On the external balance, trade data for December 2025 pointed to a wider deficit as imports outpaced exports. The Ministry of Commerce estimated total exports (merchandise plus services) at $74.01 billion and total imports at $80.94 billion for December 2025. Separately, coverage of the merchandise print highlighted a goods trade deficit of around $25 billion in December, with higher imports (including electronics and other categories) widening the gap even as exports posted modest growth. RBI’s Monetary Policy Committee (MPC) made significant changes in December 2025, unanimously cutting the repo rate by 25 basis points to 5.25% on December 5, maintaining a “neutral” stance, and injecting liquidity through Open Market Operations (OMOs) and USD/INR swaps to support growth amid lower inflation forecasts. |

|||

|

|

|||

|

|

|||

|

Brazil

Stabilizing inflation and almost full employment—and improving—are not enough to shift high-interest-rate scenario, even with strong financial markets. Inflation was down, touching 4.26% in December (versus 4.46% in November), coming in below the central bank’s upper target limit of 4.50% for the second month in a row. The three-month moving average unemployment rate slid towards 5.2%, compared with November’s 5.4%. On the financial markets, the average monthly real–US dollar exchange rate was BRL 5.45 per USD in December (BRL 5.34 in November). The Bovespa equities index trended higher in December, rising 1.2% in value; January 2026 results up until the 16th were already climbing higher, up 2.7%. Consumer confidence stayed below the neutral 100 mark, with FGV’s seasonally adjusted December reading slightly up at 90.2. Business confidence also rose slightly to 90.8. Construction confidence reached 91.4, down from November’s 92.6. |

|||

|

|

|||

|

|||

|

|

|||

|

Brazil’s manufacturing production dropped: the Monthly Industrial Physical Production (PIM) Index decreased from 113.04 in October to 103.4 in November (still above the neutral 100 line). The negative movement was driven by extractive production, which fell 6.9%, while factory production has decreased 8.8%. On aggregate, however, November 2025’s results were only 1% below those from the same period last year.

The Monthly Services Survey (PMS) revenue index slid slightly to 127.7 in November from 128.7 in October (staying above the neutral 100 line). This was mirrored in the volume index, which declined to 111.1 (from 112.8). The largest revenue decreases was in other land transportation segments (down 8.2% since October), followed by general land transportation (down 6.3%). Meanwhile, air transportation’s volumes dropped 10.9%, while other land transportation segments decreased 6.6%. The standout positive result was in technical-professional services, which expanded 6.5% in terms of revenue and 5.9% in volume. At the Banco Central do Brazil’s Monetary Policy Committee (Copom) meeting on December 10, the Selic rate was held at 15% in a unanimous decision. Copom emphasized that the current level is related to “high uncertainties” that demand “caution” in the management of monetary policy. The memo signed by the institution notes that the current rate will be at this level “for a rather prolonged period.” The next Copom meeting takes place on January 27 and 28. December’s trade balance recorded a surplus of US $9.6 billion, according to preliminary data, up from US $5.8 billion in November. The larger surplus was driven by an increase in exports (US $31 billion in December, up from US $28.5 billion in November), accompanied by a drop in imports (US $21.4 billion in December, down from US $22.5 billion in November). On January 17, a significant free trade agreement between Mercosul and the European Union was signed. According to Brazil’s president Luiz Inácio Lula da Silva, the “agreement goes beyond the economic dimension,” being positive for international relations generally. However, on January 21, the EU parliament voted to send the deal via the bloc’s top court before being ratified. |

|||

|

|

|||

|

|

|||

|

Russia

Russia’s output growth slowed further amid fiscal expansion—with modest estimates for year-end and 2026; interest rates were lowered again in December as inflation gradually slowed.

GDP grew by 1% annually in the first nine months of 2025. Sequential growth slowed to 0.1% quarterly in Q3, after 0.3% previously. Overall, 2025 growth is estimated at 0.7%. November’s preliminary estimate has shown near-zero annual growth, although to a large extent this is attributable to two fewer working days in the period. Meanwhile, extractive industries dynamics have slowed due to Ukrainian strikes on oil infrastructure and US sanctions. Manufacturing has continued its dual-track performance, with output rising in industries linked to the war effort, while nearly all other industries experienced declines. The government supported output by fiscal expansion, with to-date federal budget spending increasing by 13% in January–November. This contributed to mounting economic imbalances: labor shortages, stretched production capacities, and rising input costs. Despite expansion moderating in recent months, the budget deficit is on track to exceed 3% of GDP, versus a target of 2.6%. Consumer demand has, nevertheless, stayed brisk, despite the slowdown, with retail sales volumes up by 3% year on year. Consumer demand was sustained by strong employment and rising wages, which rose 6% annually in real terms. Consumer activity was also boosted by a one-off factor: a rush to purchase goods before a two percentage point VAT increase in January. Some forward-looking indicators suggest consumer demand already fading towards the end of last year. |

|||

|

|

|||

|

|||

|

|

|||

|

Sequential growth may become negative in Q4, hobbled by tight monetary policy, weak sentiment, and increasingly biting Western sanctions, which have caused a drop in oil export volumes.

Growth forecasts for 2026 are modest, at around 1%, with major downside risks. However, a combination of tighter sanctions and policy mix may tip the economy into recession. Resilient consumption will likely be the main growth driver in 2026, supported by rapid wage growth. On the downside, export volumes will suffer from sanctions. In December, the Central Bank of Russia decided to cut the key interest rate by 50 basis points to 16%, bringing the total cuts since June to 500 basis points. CBR needs to balance policy moves between rising inflation expectations, an acceleration in corporate borrowing, and fiscal expansion versus subsiding demand. Its policy has already been successful in mitigating household demand for credit, which turned to contraction in September and October. Tight monetary policy is still required to achieve the CBR’s inflation target of 4%. Recently, inflation has gradually slowed to 7% in November and 6% in December but the rise in VAT and regulated prices for municipal services will create upward pressure and has already started to boost expectations. |

|||

|

|

|||

|

|

|||

|

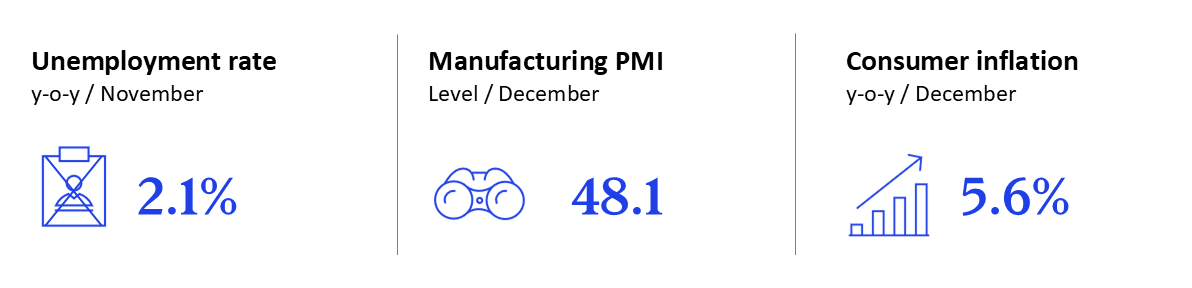

Mexico

Economic activity remained slow, while inflation eased; the peso gained ground and formal employment continued to grow. Annual inflation declined to 3.7% in December, down from 3.8% in November, reinforcing the ongoing disinflationary trend. In response to softer economic conditions and easing price pressures, the Bank of Mexico cut its policy rate by 25 basis points to 7% in December. On the currency front, the Mexican peso appreciated slightly against the US dollar, averaging MXN 18.1 per USD in December, compared with 18.4 in November. Economic momentum in the manufacturing sector remained weak. The Mexico Manufacturing PMI fell from 47.3 in November to 46.1 in December, signaling a further deterioration in operating conditions. The index has remained below the 50.0 expansion threshold for 19 of the past 20 months. New orders declined in both November and December, while new export orders contracted further, extending the downturn in external demand to 22 consecutive months. Labor market conditions showed mixed signals. The unemployment rate increased to 2.7% in November, up from 2.6% in October. At the same time, formal employment reached a record high, with 22.8 million registered jobs in November. A total of around 48,600 formal jobs were created during the month. |

|||

|

|

|||

|

|||

|

|

|||

|

On the external front, Mexico posted a trade surplus of US $663 million in November, as imports declined slightly more than exports, resulting in a positive balance despite a broad monthly contraction in trade flows. Exports fell to US $56.4 billion from US $66.1 billion in October, while imports declined to US $55.7 billion from US $65.5 billion. The surplus was largely driven by an improved non-petroleum trade balance, which more than offset the petroleum deficit, and reflected weaker import demand rather than a strengthening of export dynamics.

US tariffs imposed last year have most severely affected Mexico’s steel and aluminum exports, with steel shipments to the US declining by roughly 30% year on year in 2025, both in value and volume. Aluminum exports also fell, though to a lesser extent, while downstream metal manufactures linked to construction and heavy industry weakened. In contrast, core export categories such as automotive and consumer goods remained relatively resilient due to their deep integration under the USMCA framework. Despite these sectoral headwinds, Mexico has maintained its position as the largest exporter to the United States, well ahead of Canada and China in terms of export volumes. Against this backdrop, President Claudia Sheinbaum Pardo inaugurated the new headquarters of the Agencia Nacional de Aduanas de México (ANAM) in Nuevo Laredo, Tamaulipas, in late January 2026. As Mexico’s most important land border crossing with the United States—accounting for roughly one-third of total customs revenue and a significant share of bilateral freight traffic—the new complex centralizes core customs operations, replacing the previous administrative structure and aiming to enhance efficiency, oversight, and trade facilitation at a key logistics hub. |

|||

|

|

|||

|

|||

|

|

|||

|

|||

|

McKinsey’s Global Economics Intelligence (GEI) provides macroeconomic data and analysis of the world economy. Each monthly release includes an executive summary on global critical trends and risks, as well as focused insights on the latest national and regional developments. Detailed visualized data for the global economy, with focused reports on selected individual economies, are also provided as PDF downloads on McKinsey.com. The reports available free to email subscribers and through the

McKinsey Insights App. To add a name to our subscriber list,

click here. GEI is a joint project of

McKinsey’s Strategy and Corporate Finance Practice and the

McKinsey Global Institute.

Shubham Singhal is the Chair of McKinsey's Global Institute and a senior partner in the Detroit office; Arvind Govindarajan is a partner in the Boston office. The data and analysis in McKinsey’s Global Economics Intelligence are developed by Jeffrey Condon, a senior expert in McKinsey’s Atlanta office; Krzysztof Kwiatkowski is an expert in the Boston office. The authors wish to thank Nick de Cent, as well as José Álvares, Roman Büschgens, Darien Ghersinich, Gabriel Marini, Marianthi Marouli, Tomasz Mataczynski, Frances Matamoros, Alejandro Morales, Beatriz Oliveira, Debdoot Ray, Erik Rong, Vanshika Tandon, Valeria Valverde, and Sebastian Vargas for their contributions to this article. |

|||

|

|||

|

The invasion of Ukraine continues to have deep human, as well as social and economic, impact across countries and sectors. The implications of the invasion are rapidly evolving and are inherently uncertain. As a result, this document, and the data and analysis it sets out, should be treated as a best-efforts perspective at a specific point of time, which seeks to help inform discussion and decisions taken by leaders of relevant organizations. The document does not set out economic or geopolitical forecasts and should not be treated as doing so. It also does not provide legal analysis, including but not limited to legal advice on sanctions or export control issues.

|

|||

|

|

|||

|